What oil was for the 20th century, compute is for the 21st. The difference? We're giving it a transparent market.

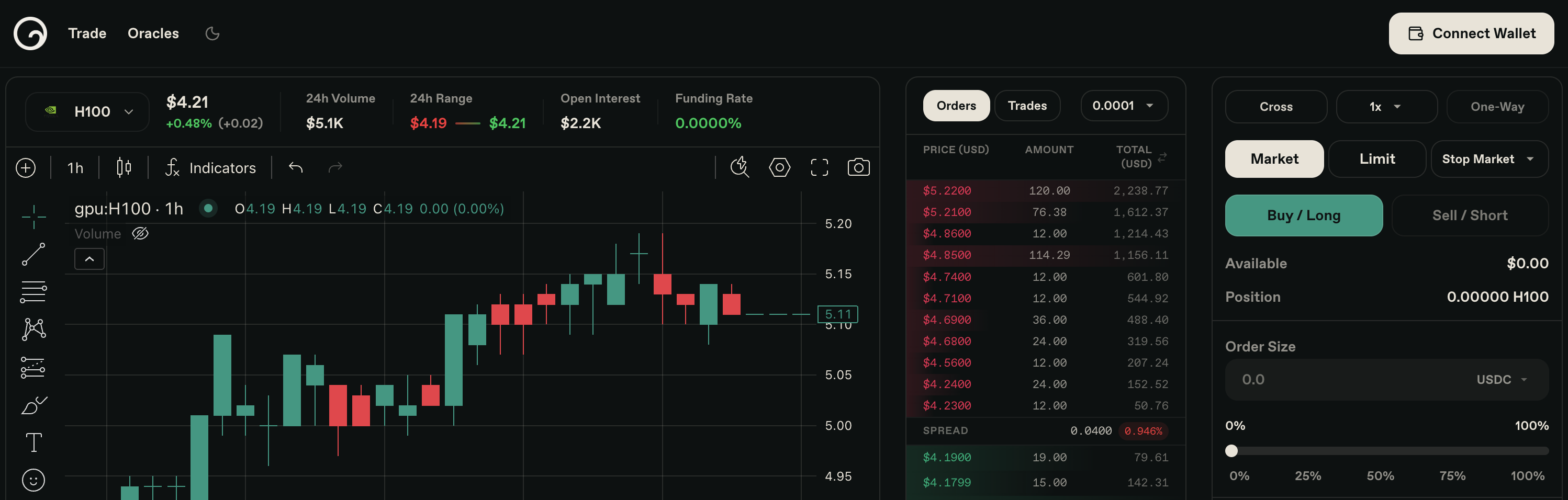

Global Compute turns GPU capacity into a tradeable market where prices for H100s, A100s, and other models move in real time.

Watch volatility, place orders, and speculate on compute demand just like you would on oil, gold, or Bitcoin.

Our H100 compute index is live on our testnet, learn the AI compute trade.

The intelligence era needs financial tools to make AGI equitable for all, trade now and get rewarded for bringing more efficieny to the market.

“Compute” is defined as the cost of a GPU per hour. For example, the compute cost H100 GPU/hour. Our price index is the market-weighted spot price of a specific GPU type and it's cost for one hour, this index is the settlement reference for our compute perpetual futures.

Currently, trading compute works similar to trading commodities, the difference is, it's cash-settled with no expiry date. You trade compute through a perpetual futures (“perp”) contract on Hyperliquid on our HIP-3 decentralized exchange. The contract settles to our index, we’ve launched this on Hyperliquid testnet, with mainnet on the roadmap.

A perpetual future (“perp”) is a futures contract with no expiry date. You can open or close a position at any time, and your P&L moves as the contract price moves relative to its reference index, for us this is the compute index price. To keep the price aligned with that index, traders pay or receive a small funding payment at set intervals (e.g., every 8-hours). Perps are margin-based (you post collateral) and can be liquidated if losses exceed your margin.

Hyperliquid is a L1 blockchain to house all finance. It's a decentralized exchange (DEX) that's permissionless and non-custodial. HyperCore engine hosts a true on-chain central-limit order book (CLOB) which makes high frequency (HFT) trading possible. HyperEVM lets smart contracts to be built directly on Hyperliquid and allows developers to build decentralized applications (dApps). With HIP-3, builders can launch their own perpetuals markets permissionlessly on top of HyperCore with shared liquidity and on-chain risk controls, essentially building "exchange-as-a-service".

We value your feedback! Reach out to us at tanisha@globalcomputeindex.com